Calculate ltv home equity loan

Learn more on how home equity line of credit and home equity loans work and compare plus calculate your estimated HELOC. LTV is used to determine how much you are eligible to borrow and is one of the factors used to determine the amount of your approved credit limit.

Loan To Value Ratio Ltv Formula And Example Calculation

550 APR Calculate.

. Your home is worth 250000 and you currently owe 180000. If you currently have a mortgage your LTV ratio is based on your loan balance. A home equity loan gives you all the money at once with a fixed interest rate.

Loan Amount Term. As mentioned above banks typically allow a max LTV of 70 to 85. Youll get the best rates and highest LTV ratios if the home equity loan is secured by a home.

LTV stands for loan-to-value ratio. But compared to a home equity loan a. Heres how youd calculate the maximum home equity loan on a 350000 home with a 250000 loan balance and an 80 LTV ratio.

View Rates Apply Now. Borrow up to 100 of your equity LTV to fund your home renovation projects. If youre taking out a home equity line of credit the amount of available equity you have in your home plays an important role.

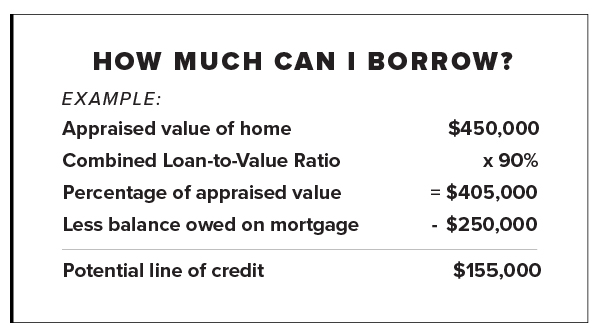

Heres how you would calculate the potential loan amount. Homeowners may use the money from these second mortgages available as a lump sum home equity loan or as a home equity line of credit for any. 400 APR Calculate.

You can compute LTV for first and second mortgages. Youd actually have to pay something to sell the assetyou wouldnt get any money out of the deal. WSECU has a maximum loan-to-value LTV of 90.

LTV ratio can affect whether you are required to have private mortgage insurance PMI or if you might qualify to refinance. Available equity in the home. A higher LTV ratio indicates more risk for the lender.

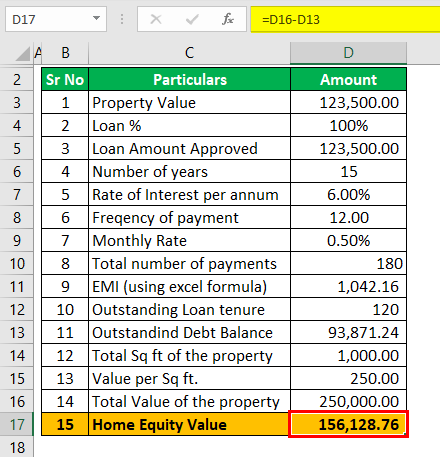

We calculate your loan-to-value ratio by taking into account the value of your home how much you owe on your first mortgage and how much you are. Home equity loan rates are dependent upon the prime rate credit score credit limits lender and loan-to-value LTV. HELOCs act more like credit cards.

And borrowers can have only one Home Equity Loan at a time. Once you know how to. So if you have 100000 in home equity as in the example above you could get a home equity line of credit HELOC of 80000 to 90000.

As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. If you require access to your assets. A loan-to-value LTV ratio is a financial term used by lenders to describe the ratio between the value of your home loan and the homes value and represent the first mortgage line as a percentage of the total appraised value of your home.

400000 x 9 360000. Calculate the equity available in your home using this loan-to-value ratio calculator. This is the amount you want to borrow.

Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home. It is the total amount of mortgages on the property ie mortgage home equity line of credit etc divided by its fair market value. Race national origin and other non-financial.

A home equity loan is a lump sum of cash thats taken out as a second mortgage against your homes equity. You can borrow what you need as you need it up to a certain limit. To calculate your LTV divide your loan amount by the homes appraised value or purchase price.

It allows home owners to borrow against. The three primary things banks look at when assessing qualification for a home equity loan are. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin.

When you first apply for a mortgage this equation compares the amount of the loan youre seeking to the homes value. For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home. Use this calculator to estimate your home equity loan payment in four steps.

Home equity loans typically. Put your homes equity to work for you with a competitive-rate Home Equity Loan or Home Equity Line of Credit from WSECU. For a home equity product lenders typically set a maximum combined LTV CLTV ratio of around 85 percent or less.

Subsequent loans depend on the amount of owners equity in the home and generally require a new appraisal. You have negative equity in that case. Filters at the top of the rate table allow you to adjust your mortgage settings.

Then choose one of the three options for enteringcalculating the number of mortgage payments made leave two of the options blank and click the Calculate Mortgage Balance button to return your current balance loan payoff amount. Like a home equity loan a home equity line of credit HELOC taps your homes existing value to generate cash you can use for any purpose youd like. Enter your loan amount.

What Its Best For. Enter the term as a. Those with good credit.

You can adjust your loan settings to change away from a 30-year 250000 fixed-rate loan on a 312500 home located in Boydton to a purchase loan a different term length a different location or a different loan amount. With a home equity loan the borrower uses the equity in their home as collateral to borrow money. The home must be in Texas and be single-family owner occupied.

360000 100000 260000. Enter your loan term. How to calculate home equity loan payments.

CUTX does not provide home equity loans or mortgages for mobile homes or manufactured homes. Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment. Lets say you find a lender whos willing to give you a HELOC with 80 LTV.

Your Credit Union for Life. People with an excellent credit score of above 760 will get the best rates. By default refinance rates are displayed.

How to calculate home equity and loan-to-value LTV Share. Your home equity is the difference between the appraised value of your home and your current mortgage balances. The loan is larger than the value of the asset securing the loan when the LTV ratio is higher than 100.

A loan to purchase a home is usually the first mortgage lien recorded on a property. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. HELOC Home Equity Loan Qualification.

If youre not sure how much youre eligible for use our home equity loan and HELOC amount calculator first. The APR will vary with Prime Rate the index as published in the Wall Street Journal. That includes houses condos townhomes or duplexes.

Home Equity Line Of Credit Heloc Uccu

Ltv Calculator For Mortgage Pmi Refinancing Mortgages Home Equity Loan Qualification

Information On 125 Ltv Home Equity Loans Mortgage Refinance Refinancing Mortgage Information Mortgage Mortg Home Equity Loan Home Equity Second Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

How To Calculate Your Home Equity Finder Com

How To Calculate Equity In Your Home Nextadvisor With Time

Applying Is Easy Save Month Buy Vs Rent Renting Vs Homeownership Loanfi Mortgage Rent Vs Buy Jumbo Loans Mortgage

What Is Harp And Do I Qualify For A Harp Loan Refinance Mortgage Refinancing Mortgage Mortgage Tips

Home Equity Loan Calculator Sale Online 53 Off Www Ingeniovirtual Com

Loan To Value Ratio Ltv Formula And Example Calculation

Home Equity Line Of Credit Heloc Rocket Mortgage

Information On 125 Ltv Home Equity Loans Mortgage Refinance Refinancing Mortgage Information Mortgage Mortg Home Equity Loan Home Equity Second Mortgage

Looking For A Heloc Calculator

What Is The Loan To Value Ltv Ratio For A Mortgage Freeandclear Mortgage Lenders Mortgage Process Mortgage Loans

Loan To Value Calculator With Dynamic Pie Chart

What Is 100 Ltv Home Equity Loan How Does It Work Mortgage Refinance Company

How To Calculate Your Loan To Value Ratio Finder Com